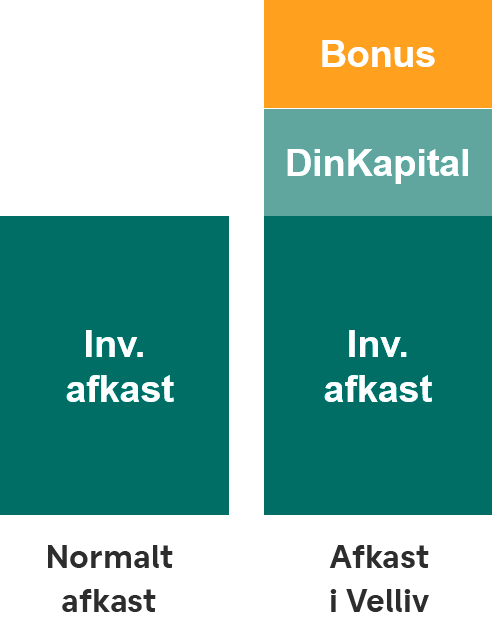

3 kilder til afkast

Hos Velliv har vi en klar ambition om at sikre kunderne et afkast, der er højere end det, der normalt er muligt at opnå på de finansielle markeder. Det sker gennem et unikt værditilbud. Vi kalder det tre kilder til afkast, der udgøres af investeringsafkast, DinKapital og Bonus fra Velliv Foreningen.

Gode investeringsafkast

Med et samlet afkast på henholdsvis 51,3 pct. og 55,2 pct. har VækstPension Index og VækstPension Aktiv over de sidste fem år leveret nogle af branchens bedste afkast for kunder med mellem risiko og 15 år til pension.

Få endnu mere ud af din opsparing med DinKapital

DinKapital giver kunderne en årlig høj rente på p.t. 4,5 pct. 96% af alle nye virksomhedskunder har automatisk tilknyttet DinKapital. Afkastet fra DinKapital giver kunderne en solid bund under pensionsopsparingen – ikke mindst i perioder med lave renter og volatilitet på de finansielle markeder. Læs mere her.

Om bonus

Velliv Foreningen har i år besluttet at udbetale 400 mio. kr. i bonus til medlemmerne – det vil sige kunderne i Velliv. Det svarer til 1.638 kr. pr. opsparet mio. kr. eller 0,1638 %. af den samlede opsparing pr. 31. december 2023. Kunder med en lille opsparing eller rene forsikringsordninger vil modtage en grundbonus på 150 kr.

”Vores unikke værditilbud, hvor vores kunder via medlemskab af Velliv Foreningen også er ejere af Velliv, betyder, at alle Vellivs kunder får et kontant beløb i hånden – både når de sparer op, og når de er gået på pension. Det er en ekstra bonus ved at være i Velliv,” siger adm. direktør, Kim Kehlet Johansen.

I starten af maj får du som kunde besked i e-Boks om størrelsen på den bonus, du får udbetalt omkring den 22. maj 2024.

I tabellen nedenfor ser du, hvad Velliv Foreningen har givet i bonus siden 2018, som var det første år, hvor foreningen udbetalte bonus. Samlet set har kunderne siden 2018 modtaget 10.688 kr. i bonus pr. mio. opsparet – eller i gennemsnit 1.527 kr. om året.

Du kan se mere om bonus på vellivforeningen.dk.

|

Udbetaling af bonus fra Velliv Foreningen. Opsparing på 1 mio. kr. |

||

|

Udbetalingsår |

Bonussats, pct. |

Årlig udbetaling, kr. |

|

2024 |

0,164 |

1.638 |

|

2023 |

0,000 |

0 |

|

2022 |

0,200 |

2.000 |

|

2021 |

0,147 |

1.470 |

|

2020 |

0,145 |

1.450 |

|

2019 |

0,145 |

1.450 |

|

2018 |

0,268 |

2.680 |

|

I alt, kr. |

|

10.688 |

|

Gennemsnit pr. år, kr. |

0,153 |

1.527 |

Regn på bonus her, og læs mere om Velliv Foreningens medlemsbonus her