Velliv’s view on fossil fuel investments

The world needs to transition from fossil fuels to renewable energy if we are to achieve the goals of the Paris Agreement.

A complete phasing out of fossil fuels will take many years, as oil and natural gas remain necessities for now, and a transition will require both companies and society to undertake major changes. Nevertheless, there is an urgent need to accelerate the green transition, and experts have shown time and again that we will not need the same amount of fossil fuels in the future.

Unfortunately, we can still see – here, 9 years after the Paris Agreement was adopted – that very many fossil fuel companies have failed to confront the seriousness of the situation. A number of utility companies have already embraced the green transition and replaced fossil fuels with green alternatives, yet we have not seen the same tendency among energy companies despite investors endeavouring to push them in a more sustainable direction through active ownership and dialogue. This is why we do not view engaging in dialogue with these companies as a meaningful tool for influencing the green transition. Instead we will prioritise dialogue with companies where we believe we have a greater chance of influencing positive change.

Yes to companies that meet Velliv’s criteria

Going forward, Velliv will invest in fossil fuel companies that we assess are on a path to a green transition. In contrast, we will exclude fossil fuel companies that we assess to be slowing down the necessary transition. Companies must have implemented measures and be actively working to align their actions and ambitions with the Paris Agreement, and be able to document this. Velliv employs specific criteria and data to select companies eligible for investment.

As a consequence of Velliv’s new approach to investments in fossil fuels, several companies have been excluded from Velliv’s investment universe. These include energy companies like BP, TotalEnergies and Shell, all of which continue to have plans for significant fossil fuel extraction in the future.

To achieve a change in behaviour, action is required from politicians, investors and consumers alike. Oil and natural gas companies can only continue their fossil fuel expansion as long as governments allow further development of new oil fields, consumers demand for fossil fuels is still high and investors support further expansion.

We in no way believe that our stance will solve global warming, but we do hope that our openness and focus on this topic will have a ripple effect, and with time change behaviour in this area, so that we will be able to include more companies involved in fossil fuels in our investment universe over the coming years.

-

What is a fossil fuel company?

A fossil fuel company is a company engaged in fossil fuel activities. For example, companies that extract, produce, provide services for, transport or refine fossil fuels.

Our approach applies only to investments in fossil fuel companies where more than 5% of their revenue is derived from the extraction or production of, or energy production from, coal, oil and/or natural gas. Such companies are also known as upstream fossil fuel companies and energy utility companies.

-

Which products are covered by the new approach?

The approach applies to Velliv’s portfolio of listed equities and corporate bonds that Velliv has in its own custody accounts. Velliv cannot guarantee that external funds will comply with the exclusion list where Velliv does not have a controlling influence. With other asset classes, the approach is implemented to the extent possible.

-

What is the green transition?

The green transition means transforming our economy from one that is dependent on fossil fuels to one that relies on renewable energy sources and is more resource efficient. It is the changes that are needed, so that human activity no longer endangers the planet.

A fossil fuel company undergoing a green transition should here be understood as a company with fossil fuel activities that is in the process of replacing those activities with green alternatives.

The Paris Agreement

The Paris Agreement is an international treaty adopted by 195 countries in Paris in December 2015 and ratified by the governments of around 171 countries. The treaty aims to limit greenhouse gas emissions in order to keep the increase in global average temperatures below 2 degrees Celsius and preferably below 1.5 degrees Celsius.

Our approach

Going forward, Velliv will invest in fossil fuel companies which we assess are on a path to a transition that supports the goals of the Paris Agreement and, conversely, divest companies that we deem to be slowing down the transition.

What we won't invest in

At Velliv, we will not invest in:

- companies that extract coal (5% of revenue) or have plans to expand their coal activities. Coal is one of the worst sources of fuel we can extract and use for energy in terms of climate impact, and plans to extract new coal are not compatible with the Paris Agreement.

- companies that employ unconventional extraction methods (5% of revenue), which covers oil sands, Arctic drilling and fracking. Unconventional extraction methods are used in the oil and natural gas industries to extract oil or natural gas using techniques other than traditional vertical well extraction. These methods are detrimental to the climate, environmentally harmful and a health hazard for local communities.

Fossil fuel companies in transition

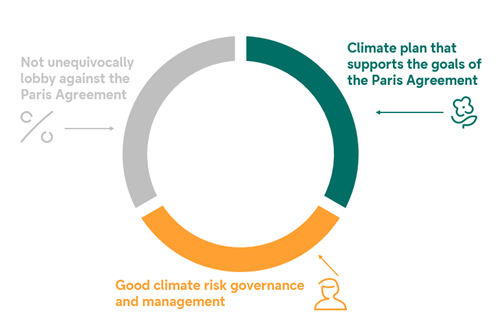

With respect to other fossil fuel companies, Velliv will only invest in companies that we assess are on a path to a green transition. They must have made tangible progress towards the Paris Agreement, introduced measures, and worked to align their actions and ambitions with the treaty. To measure this, a company should be able to meet the following criteria:

-

have a climate plan that supports the goals of the Paris Agreement

A company must have set ambitious climate targets aligned with the Paris Agreement that have been assessed by independent external agencies and have no documented plans to expand within oil or natural gas.

A publicly disclosed climate targets means commitment, while specific and concrete sub-goals for the coming years enable Velliv and the general public to track a company’s progress.

In addition, companies should have no future plans for expansion into new oil or natural gas projects. The International Energy Agency, IEA, has determined that investments in new fossil fuel extraction commencing in 2022 or later are not compatible with a scenario of achieving the goals of the Paris Agreement, while existing fields will be sufficient to meet demand for oil and gas. Hence, plans for new fossil fuel extraction are in conflict with the goals of the Paris Agreement.

Criteria:

- A company should have set a Science-Based Target or a so-called “ambitious target”. We use external data provider ISS ESG to assess whether a company’s climate targets can be viewed as compatible with the Paris Agreement.

- The company should have no plans for expansion within oil or natural gas. Based on information from Urgewald, which assesses a company’s plans for fossil fuel expansion (EXIT list oil and natural gas upstream: IEA NZA overshoot over 0%). Only relevant for companies where information is available.

-

not unequivocally lobby against the Paris Agreement

A company’s documented engagement in climate policy should not be unequivocally in conflict with the Paris Agreement.

Lobbying can influence the climate debate and the position of politicians on fossil fuels. This could be via statements, support or general interactions with authorities.

Criteria:

- A company’s engagement in climate policy should not be unequivocally obstructive. Based on information from Influencemap, which assesses a company’s lobbying of authorities, etc. and its work in industry associations (Corporate Climate Policy Engagement, score over D+). Only relevant for companies where information is available.

-

have good governance and management in regards to climate *

A company’s CO2 emissions and climate risks should be well managed and controlled, for example by disclosing emission figures and integrating climate risks into its operational decision-making processes. This should be assessed by independent external agencies.

Good governance and controls are necessary to ensure a company delivers on its climate ambitions. A company needs, for example, to have knowledge, processes and to disclose its CO2 emission figures, to integrate climate risks into its operational decision-making processes, and to have the board of directors supervise the area.

Criteria:

- The company should have a high score in the Transition Pathway Initiative, which assesses a company’s management of CO2 emissions and climate risks (Management Quality level 3 or 4). For companies lacking an assessment, we use the Carbon Disclosure Project (Climate Change, score over C). If there is no information on a company, it cannot meet the criterion.

* does not apply to companies that have committed to or set a Science Based Target.

Back in our Investment Universe

A company that cannot meet our criteria will be ineligible for investment. To become eligible for investment again, Velliv requires that the company changes its plans, behaviour or practices so they align with the goals of the Paris Agreement.

Our hope and expectation is that Velliv over time will exclude fewer and fewer companies as more companies step up and work on transition plans aligned with the Paris Agreement, and we also obtain better data and coverage that enables us to evaluate companies better.